Selling price is the amount of money a customer pays to acquire a product or service. It’s a crucial factor in determining a business’s profitability. The selling price is typically calculated by adding a markup or profit margin to the cost of goods sold (COGS).

Selling vs. cost price

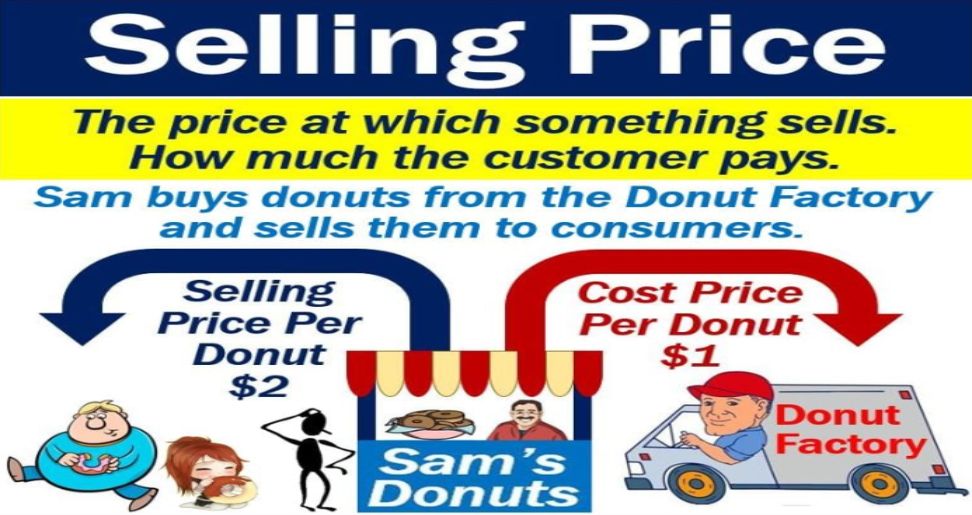

Selling price is the amount a product or service is sold for to a customer. It’s the revenue generated from each transaction. Cost price, on the other hand, is the total cost incurred in producing or acquiring the product or service. This includes the cost of raw materials, labor, overhead expenses, and any other costs associated with bringing the product to market. The difference between selling price and cost price is known as profit, which is the primary goal of any business. Understanding the relationship between selling price and cost price is crucial for setting competitive prices, determining profitability, and making informed business decisions.

Determining the selling price

Setting the optimal selling price for a product or service is a critical decision that significantly impacts a business’s profitability. Several factors must be considered when determining the selling price, including the cost of goods sold (COGS), desired profit margin, market demand, competitive pricing, and customer perception of value. COGS represents the direct costs associated with producing or acquiring a product, while the desired profit margin is the percentage of revenue a business aims to retain after deducting expenses. Market demand refers to the level of consumer interest and willingness to purchase a product at a specific price. Competitive pricing involves analyzing the prices of similar products offered by competitors to ensure competitiveness. Customer perception of value is the customer’s belief that a product or service is worth the asking price based on its perceived benefits and quality. By carefully evaluating these factors, businesses can establish a selling price that maximizes revenue and profitability while meeting customer expectations.

Understanding “Selling Price” in Different Contexts

The “selling price” of a product or service is the amount of money a customer pays to acquire it. This price is influenced by various factors, including the cost of production, market demand, competition, and the seller’s profit margin. In retail settings, the selling price is typically calculated by adding a markup percentage to the cost price. This markup covers the retailer’s expenses, such as rent, utilities, and employee wages, as well as contributes to their profit. In wholesale transactions, the selling price is often set at a lower rate to encourage bulk purchases and maintain relationships with distributors or retailers. In the context of auctions, the selling price is determined by the highest bid offered by a potential buyer. Additionally, in online marketplaces, sellers may use dynamic pricing strategies to adjust the selling price based on factors like time of day, inventory levels, and customer behavior.

Components of Selling Price

The selling price of a product or service is typically calculated by adding the following components:

- Cost of Goods Sold (COGS): Cost of Goods Sold (COGS) is a crucial metric in accounting that represents the direct costs incurred in producing and selling goods or services. It includes the cost of materials, labor, and manufacturing overhead directly related to the creation of products. COGS is calculated by adding the beginning inventory to purchases made during the period and then subtracting the ending inventory. This figure is essential for determining a company’s gross profit, which is the revenue generated from sales minus COGS. COGS is typically reported on the income statement and provides insights into a company’s profitability and operational efficiency.

- Operating Expenses: Operating expenses, often referred to as OPEX, encompass the recurring costs incurred in the day-to-day operations of a business. These expenses are essential for maintaining the company’s core functions and ensuring its continued viability. They typically include costs related to salaries and wages, rent or lease payments, utilities (such as electricity, water, and gas), office supplies, marketing and advertising, insurance premiums, maintenance and repairs, and professional fees (e.g., legal, accounting). Operating expenses are directly linked to the business’s revenue generation and can significantly impact its profitability. Effective management of operating expenses is crucial for businesses to maintain a healthy financial position and achieve long-term success.

- Profit Margin: Profit Margin is a financial ratio that measures the profitability of a company. It indicates how much profit a company generates for every dollar of revenue it earns. A higher profit margin generally signifies that a company is more efficient in its operations, as it is able to generate more profit from each sale. However, it’s important to consider that a high profit margin doesn’t necessarily mean a company is highly profitable overall, as it depends on the overall revenue generated. Factors such as pricing strategies, cost management, and competition can all influence a company’s profit margin.

Factors Affecting Selling Price

Several factors can influence the selling price of a product or service:

- Market Demand: Market demand is the total quantity of a product or service that consumers are willing and able to purchase at a given price during a specific period. It is influenced by various factors, including consumer preferences, income levels, prices of related goods, and consumer expectations. When the price of a product decreases, consumers tend to demand more, while an increase in price generally leads to a decrease in demand. Understanding market demand is crucial for businesses as it helps them make informed decisions regarding production levels, pricing strategies, and marketing efforts. By accurately assessing market demand, companies can optimize their operations and maximize profitability.

- Competition: Competition is a fundamental element of human interaction, driving innovation, progress, and the pursuit of excellence. In various spheres of life, from the corporate world to academia and sports, individuals and organizations strive to outperform one another. This competition can be a healthy motivator, encouraging individuals to reach their full potential and pushing boundaries. However, it can also lead to negative consequences, such as unethical behavior, stress, and a sense of inadequacy. The key to harnessing competition lies in maintaining a balance between the drive for success and the values of fairness, sportsmanship, and cooperation.

- Perceived Value: Perceived Value is a customer’s subjective assessment of the worth of a product or service relative to its price. It’s not just about the tangible benefits like features or quality, but also includes intangible factors like brand reputation, customer service, and the overall experience. Customers weigh these factors against the price to determine if they feel the product or service is worth the cost. A high perceived value can lead to increased customer satisfaction, loyalty, and willingness to pay a premium price. Conversely, a low perceived value can result in customers seeking alternatives or negotiating a lower price.

- Economic Conditions: The current economic landscape is characterized by a delicate balance between growth and uncertainty. While the global economy has shown resilience in recovering from recent challenges, several factors continue to influence its trajectory. Persistent inflation, coupled with rising interest rates, has created a challenging environment for businesses and consumers alike. Supply chain disruptions and geopolitical tensions have also contributed to economic volatility. However, there are signs of optimism, as technological advancements and increased investments in renewable energy offer potential avenues for sustainable growth. Overall, the economic outlook remains uncertain, and policymakers are closely monitoring developments to implement appropriate measures to ensure a stable and prosperous future.

- Pricing Strategy: A company’s pricing strategy can also influence the selling price. Common pricing strategies include cost-plus pricing, value-based pricing, competitive pricing, and penetration pricing.

Importance of Selling Price

Setting the right selling price is crucial for a business’s success for several reasons:

- Profitability: A well-set selling price can help a company achieve its desired profit margin and ensure long-term financial health.

- Market Share: Competitive pricing can help a company gain market share and attract new customers.

- Customer Satisfaction: Pricing that is perceived as fair and reasonable can contribute to customer satisfaction and loyalty.

- Business Growth: Effective pricing can support business growth and expansion.

Read More :

Featured Image Source: https://tinyurl.com/8bxbhweh