In the intricate world of finance, particularly within the realm of investment strategies, the term “alpha spread” often arises. It’s a concept that, while seemingly straightforward, requires a nuanced understanding to grasp its significance.

Alpha spread is essentially the difference between the actual return generated by an investment portfolio and its expected return. The expected return is typically calculated based on a benchmark index or a risk-free rate.

What is Alpha Spread?

Alpha Spread is a measure of a portfolio’s excess return relative to a benchmark index. It’s calculated by subtracting the benchmark’s return from the portfolio’s return. A positive alpha indicates that the portfolio outperformed the benchmark, while a negative alpha

suggests underperformance. Alpha is often used to evaluate the skill of a fund manager or the effectiveness of an investment strategy. However, it’s important to note that alpha can be influenced by factors beyond the manager’s control, such as market conditions and economic trends. Therefore, it’s crucial to consider alpha in conjunction with other performance metrics when assessing an investment’s overall returns.

Alpha Spread Review: The Features

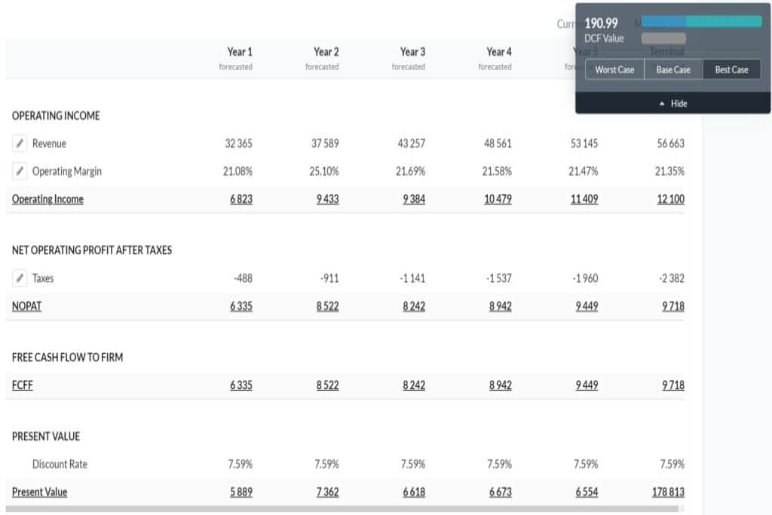

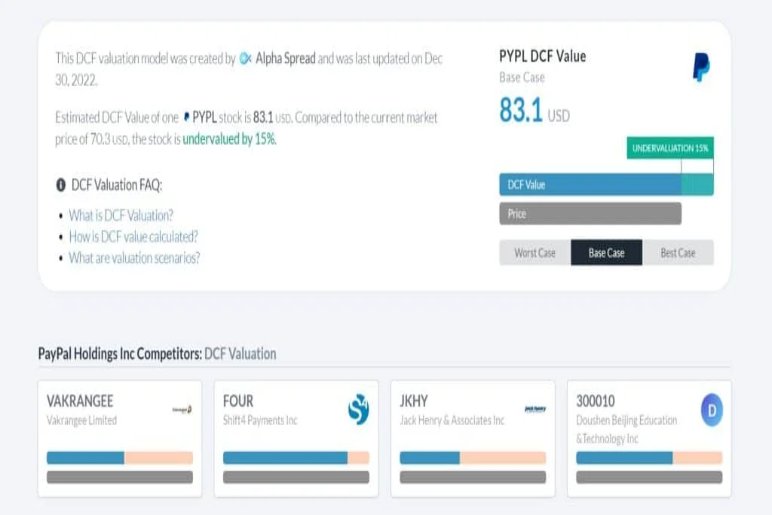

- Valuation Models: Valuation models are essential tools in finance that help determine the intrinsic value of an asset, whether it’s a stock, bond, business, or real estate. These models analyze various factors such as cash flows, growth rates, risk, and market conditions to provide a fair estimate of an asset’s worth. There are several primary valuation models, including the discounted cash flow (DCF) method, which calculates the present value of future cash flows, the relative valuation method, which compares the asset to similar assets based on metrics like price-to-earnings (P/E) ratios or price-to-book (P/B) ratios, and the asset-based valuation method, which estimates the value based on the underlying assets and liabilities. By understanding these models, investors can make informed decisions about buying, selling, or holding assets.

- Relative Value Modeling: Relative Value Modeling is a quantitative approach used to assess the attractiveness of securities relative to one another based on various financial metrics and market conditions. It involves comparing the expected returns and risks of different assets within a specific asset class or sector. By analyzing relative value, investors can identify securities that are undervalued or overvalued compared to their peers. This modeling technique often incorporates factors such as financial ratios, credit ratings, market trends, and economic indicators to determine the relative worth of securities. It is a valuable tool for portfolio managers, hedge fund managers, and other investment professionals who seek to make informed investment decisions and potentially outperform the market.

- Intrinsic Value Calculation: Intrinsic value calculation is a fundamental analysis technique used to determine the true worth of an asset, such as a stock or a business.

It’s based on the premise that an asset’s value is derived from its future cash flows. To calculate intrinsic value, analysts typically employ the discounted cash flow (DCF) method, which involves forecasting future cash flows and discounting them back to their present value using an appropriate discount rate. This discount rate, often calculated as the weighted average cost of capital (WACC), reflects the risk associated with the investment. By comparing the intrinsic value to the market price, investors can assess whether an asset is overvalued, undervalued, or fairly priced. This approach is a cornerstone of value investing, where investors seek to purchase assets at a price significantly below their intrinsic value, betting on the market’s eventual recognition of the true worth.

- Stock Screener: A stock screener is a powerful tool used by investors and traders to filter and identify potential investment opportunities from a vast pool of stocks. It allows users to input specific criteria, such as market capitalization, price-to-earnings ratio (P/E), dividend yield, industry sector, and more, to narrow down the list of stocks that meet their investment objectives. By efficiently sifting through data, stock screeners save time and effort, enabling investors to focus on analyzing promising candidates. These tools can be particularly valuable for those who follow a particular investment strategy or have specific risk tolerance levels.

- Analyst Estimates: Analyst Estimates are forecasts made by financial analysts regarding a company’s future performance. These estimates typically include projections for revenue, earnings per share (EPS), and stock price. Analysts base their predictions on a variety of factors, such as the company’s financial health, industry trends, macroeconomic conditions, and competitive landscape. These estimates can be valuable tools for investors, as they provide a benchmark against which to measure a company’s actual performance. However, it’s important to note that analyst estimates are not always accurate, and investors should consider multiple sources of information when making investment decisions.

- Comprehensive Financial Analysis: Comprehensive Financial Analysis is a systematic process of examining a company’s financial statements to assess its performance, financial health, and future prospects. It involves a deep dive into the income statement, balance sheet, and cash flow statement, using various financial ratios and metrics to evaluate profitability, liquidity, solvency, and efficiency. By analyzing trends over time and comparing the company’s performance to industry benchmarks, investors and stakeholders can gain valuable insights into the company’s financial position, identify strengths and weaknesses, and make informed decisions about investments or business strategies.

- Scientific Valuation Models: Scientific valuation models are quantitative techniques used to estimate the intrinsic value of an asset, typically a company. These models are rooted in financial theory and employ various financial metrics, such as cash flows, earnings, and growth rates, to determine the present value of future benefits. Common scientific valuation models include the discounted cash flow (DCF) model, which calculates the present value of future cash flows, and the dividend discount model (DDM), which focuses on the present value of future dividends. These models are widely used by investors, analysts, and corporate finance professionals to make informed decisions about asset valuation and investment strategies. By providing a structured and data-driven approach, scientific valuation models offer a valuable tool for assessing the financial worth of an asset.

- Educational Resources: Educational resources are essential tools for learning and development. They can take many forms, such as books, articles, online courses, videos, and interactive simulations. These resources provide students with the knowledge, skills, and understanding they need to succeed in their academic pursuits. They can be used in various settings, including schools, universities, and homes. Educational resources can be tailored to specific subjects, age groups, and learning styles, making them accessible to a wide range of learners. By utilizing a variety of educational resources, students can enhance their learning experience and achieve their educational goals.

Alpha Spread Pricing

Alpha Spread Pricing is a sophisticated pricing strategy that aims to maximize profit by strategically adjusting product prices based on customer demand and competitive dynamics. It involves meticulously analyzing various factors, including historical sales data, market trends, customer behavior, and competitor pricing, to identify optimal price points. By carefully balancing price with demand, businesses can increase revenue and market share. This approach is particularly effective in industries with dynamic pricing environments, such as retail, e-commerce, and travel, where fluctuations in demand and competition are common.

- Free Plan: The Free Plan offers a basic level of access to our platform, designed to provide a taste of our features and benefits. While it may have limitations compared to our premium plans, it’s still a valuable option for those who want to explore our services without committing to a paid subscription. The Free Plan typically includes core functionalities, such as creating a basic profile, limited interactions, and access to certain community features. It’s a great starting point for individuals who are new to our platform or want to test the waters before investing in a more comprehensive plan.

- Unlimited Plan: An unlimited plan, often offered by telecommunications providers, provides subscribers with a virtually unrestricted amount of data usage, voice calls, and text messages within a specific coverage area. This means users can browse the internet, make phone calls, and send texts without worrying about exceeding data limits or incurring additional charges. Unlimited plans are particularly appealing to heavy users who require consistent connectivity for work, entertainment, or personal use. However, it’s important to note that while the data may be unlimited, network congestion, especially during peak usage times, can affect download and upload speeds. Additionally, some providers may impose fair usage policies to prevent excessive data consumption that could impact network performance for other users.

- Enterprise Plan: An enterprise plan is a comprehensive strategic blueprint designed to guide an organization towards long-term success. It outlines the company’s vision, mission, goals, and strategies to achieve them. A well-crafted enterprise plan encompasses various aspects, including market analysis, competitive landscape, financial projections, resource allocation, risk assessment, and operational plans. It serves as a roadmap for decision-making, ensuring that the organization’s efforts are aligned with its overall objectives. By developing and implementing an effective enterprise plan, businesses can enhance their competitiveness, improve efficiency, and foster sustainable growth.

Read More :

Featured Image Source: https://tinyurl.com/yms76fdz